Tag: CBK

Latest Article 8 Mar 2024

Kenyan banking sector balances strong profits with sovereign exposure challenges

Fitch Ratings recently conducted a peer review, where they assessed the creditworthiness of three bank holding companies – KCB Group PLC, NCBA Group PLC, and I&M Group Plc – along with their Kenyan banking subsidiaries and Stanbic Bank Kenya Limited. The rating given to these entities was the same as the sovereign Long-Term Issuer Default […]...

Read MoreMore on Tag: CBK

Kenya’s fiscal landscape: A Review of the 2024 Budget Policy Statement and its implications on businesses

Background The Budget Policy Statement (BPS) is a government policy document that sets out the broad strategic priorities and policy goals to guide the National Government and County Governments in pr...

CBK agriculture survey: Sector shows resilience, expects price decline despite challenges.

The Central Bank of Kenya released the Agriculture Sector Survey for January 2024, highlighting the sector’s significant contribution to the country’s economy. Accounting for an estimate...

BRICS at a glance: Funding opportunities for Africa and the risks

The new world order known as BRIC, a group acronym referring to Brazil, Russia, India, and China, has been trying to take over economic dominance from the West and have more sovereignty and autonomy.�...

A Primer: The Kenya Foreign Exchange Code

Over time, the country’s financial landscape has witnessed tremendous growth and transformation. Amidst the laudable growth and transformation, numerous risks and weaknesses have been exposed. As a ...

An overview of the Tax Procedures Act (No. 29 Of 2015) (Common Reporting Standards) Regulations, 2023

The Tax Procedures (Common Reporting Standards) Regulations, 2023 took effect on January 1, 2023. The Regulations are significant steps towards the global movement to increase tax transparency due to ...

Supplementary Budget 2022/2023: An Analysis

Recently, the National Assembly called for memoranda on the Supplementary budget 2022/2023 tabled before the House for approval. This budget was much awaited as President Ruto has promised to cut down...

13th January Trade and Financial Services Round Up

Kenya State bursts recurrent budget forecast by Sh81.7bn President William Ruto’s administration projects expenditure for the day-to-day running of the government is Sh81.7 billion more than what th...

Cytonn’s dilemma in the face of liquidation order

A high court ruling in Kenya this week has ordered the liquidation of two funds owned by Cytonn Real Estate – Cytonn High Yields Solution (CHYS) and the Cytonn Real Estate Project Notes (CPN) &#...

Banks to use Treasury bonds as loan collateral

As part of measures aimed at increasing industry liquidity and relieving the Central Bank of Kenya (CBK) from frequently having to bail out cash-strapped institutions, banks will soon be able to borro...

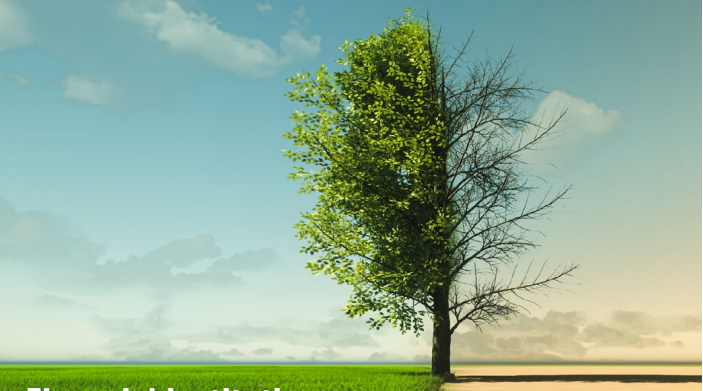

Financial institutions must build internal capacity to address climate change risks

The effects of climate change have caught up with us, and they pose significant risks to different sectors. The agricultural sector is the worst hit due to changes in weather patterns and extended dro...

Gachagua gaffes his way in

Shortly after midnight last Sunday, the Central Bank of Kenya sent out a press release.It was to correct the assertion by Deputy President Rigathi Gachagua had made a fewhours before, in an interview ...

© 2024 Vellum. All Rights Reserved.