Financial institutions must build internal capacity to address climate change risks

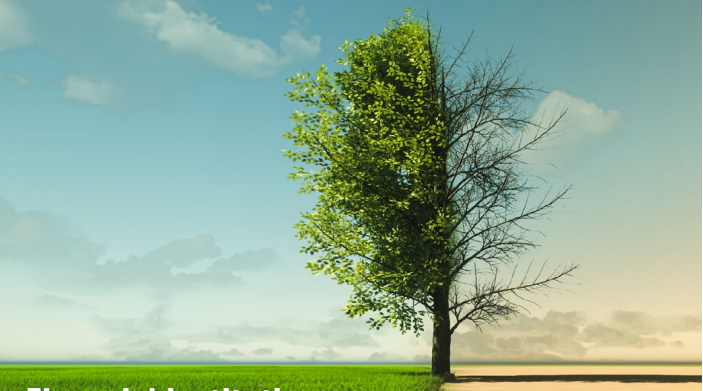

The effects of climate change have caught up with us, and they pose significant risks to different sectors. The agricultural sector is the worst hit due to changes in weather patterns and extended drought periods. The financial sector has also been greatly affected because climate change is a big source of financial risks. The risks include physical risks, extreme weather events, and transition risks, such as uncertainties relating to shifting towards a low-carbon economy.

As a result of climate change, future cash flows become unpredictable, and the value of assets used as security for loans is likely to decrease; hence, lenders face huge losses if borrowers cannot meet their repayments. Financial institutions play a pivotal role in climate financing for mitigation and adaptation purposes. They provide the financial resource necessary for the transition. However, the climate risks pose a great threat to their asset.

In November last year, the Central Bank of Kenya (CBK) deployed Guidelines for Banks to Manage Climate-related financial risk bearing the fact that climate change is an existential threat. In line with that, CBK tasked commercial banks to develop individual climate-related risk financial management road maps and plans.

Paris alignment refers to the alignment of public and private financial flows with the objectives of the Paris Agreement on climate change. Article 2.1c of the Paris Agreement defines this alignment as making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development. Alignment in this way will help to scale up the local financial flows needed to strengthen the national response to the threat of climate change.

Actioning response entails mainstreaming Task Force on Climate-related Financial Disclosures (TCFD) within the internal financial systems and operations. It also considers climate disclosures and possible implications for the wider financial system within Kenya.

The TCFD was established to guide financial institutions in making effective climate disclosures. In 2017, it released recommendations for doing so, and these are considered the preferred framework. The application of TCFD recommendations by commercial banks to date has been limited, but more are committing to increase their climate-related disclosures and apply the recommendations. The TCFD recommendations are principles-based and allow for flexibility in their application, therefore, financial institutions should apply these principles based on the CBK mandate and operational framework to address the most relevant and material areas of financial systems.

A progressive approach to developing climate-related disclosures should be adopted regarding the type, and level of granularity of the information disclosed, recognising that data and methodologies will improve over time.The development of high-quality, reliable, comparable and transparent climate disclosures can support decision-making and enable a better understanding of the implications of climate change for commercial banks.

Going forward, financial institutions should establish a risk assessment framework for risk assessment and mitigation. The financial institutions should also create the necessary technical expertise and resources (such as systems and data) to provide climate-related disclosures. A robust internal governance process and buy-in from all stakeholders must also be sought to ensure that TCFD Is thoroughly understood and implemented.