Key tax highlights in the Finance Bill: An overview of notable proposed changes

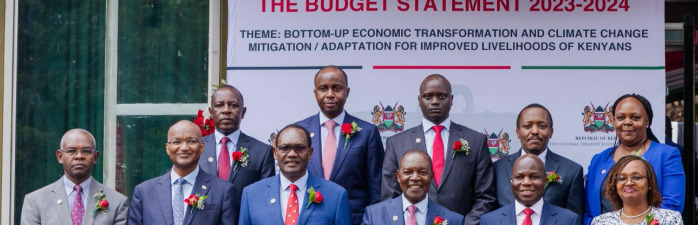

Following the tabling of the Finance Bill, 2023 before the National Assembly on 28th April 2023, the Cabinet Secretary for National Treasury and Economic Planning (CS) read his budget statement on 15th June 2023. He outlined a series of tax policy measures for the fiscal year 2023/2024. Below is a summary:

Excise duty

The tax measures for excise duty include:

Remittance of excise duty on betting and gaming activities. This is a proposal to provide for the remittance of the excise duty on betting and gaming activities within 24 hours after the closure of transactions by the betting and gaming companies. This is a proposal to increase the rate of excise duty on betting, gaming, prize competition and lotteries from the current rate of 7.5% to 12.5%.

Introduction of excise duty on powdered juice – this is a proposal to introduce excise duty on powdered juice at a rate of KES 25 per kilogram.

Introduction of excise duty on imported sugar – this is a proposal to introduce excise duty on imported sugar at the rate of KES 5.0 per kilogram excluding the sugar imported or purchased locally by registered pharmaceutical manufacturers for use in the manufacture of pharmaceutical products.

Introduction of excise duty on advertisements promoting alcohol, betting, gaming, lottery, and prize competition – this is a proposal to introduce excise duty at the rate of 15% of the excisable value on fees charged on the advertisements by all televisions, print media, billboards, and radio stations in the promotion of alcohol, betting, gaming, lottery and prize competition.

Reduction of excise duty on money transfer services – this is a proposal to reduce excise duty from 12% to 10% of the excisable value on fees charged for money transfer services by cellular phone service providers or payment service providers licensed under the National Payment System.

Import Duty

The proposals are aimed at addressing food shortages in the country and protecting local industries. The proposals include

- Reduction of the rate of import duty on rice from 75% to 35%.

- Wheat to be imported under the EAC duty remission scheme at the rate of 10% upon recommendation by the Ministry of Agriculture who will ensure that wheat millers purchase local wheat before being allowed to import under the duty remission scheme.

- Completely Knocked Down kits for assembly of motorcycles to attract import duty at the rate of 10% under the EAC Duty Remission Scheme awaiting finalisation of Assembly Regulations at the EAC level.

- Duty-free importation of inputs for assembly of smartphones and other cellular phones extended.

VAT

The proposed amendment suggests zero-rating VAT on LPG to promote affordability, encourage its uptake, and foster the use of clean energy sources. This proposal recommends amending the VAT Act to remove the preferential rate on petroleum products, subjecting them to the standard VAT rate of 16%. Exported services are to be zero-rated. This proposal recommends zero-rating exported taxable services to enhance competitiveness and encourage their exportation.

Other key tax measures

Currently, the Turnover tax applies to businesses that generate a turnover of between KSh 1 million and KSh 50 million at the rate of 1%. Finance Bill, 2023 proposed to increase the rate of tax to 3% and have the tax apply to reduced turnover bands of KSh 0.5 million – KSh 15 million. In his speech, the CS signalled that he was looking to maintain the proposed rate of 3% but that the tax would apply to turnover of between KSh 1 million and KSh 25 million.

Finance Bill, 2023 included proposals to tax digital content monetisation at the rate of 15%, which caused uproar among the content creation community. The CS has proposed to reduce the tax rate to 5%, which is similar to the WHT rate on payments made for professional services.

Finance Bill, 2023 included proposals to tax digital content monetisation at the rate of 15%, which caused uproar among the content creation community. The CS has proposed to reduce the tax rate to 5%, which is similar to the WHT rate on payments made for professional services.