KENYA WEEKLY MARKET WRAP

EQUITY MARKET COMMENTARY

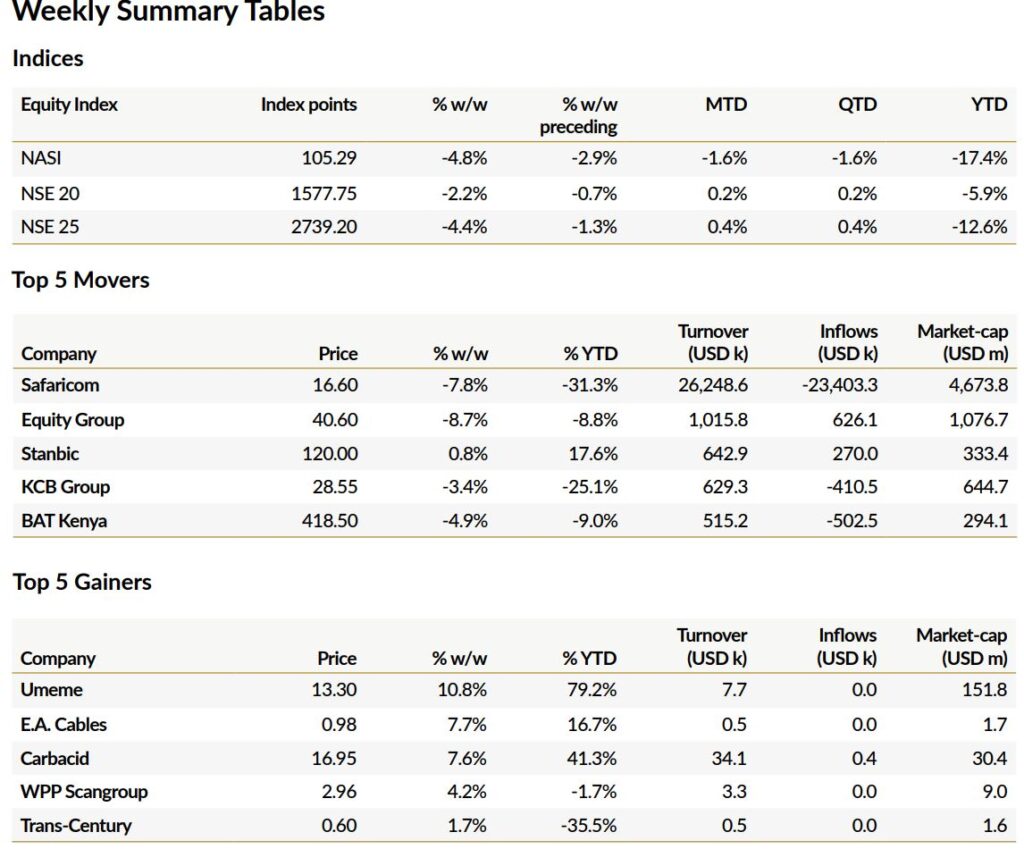

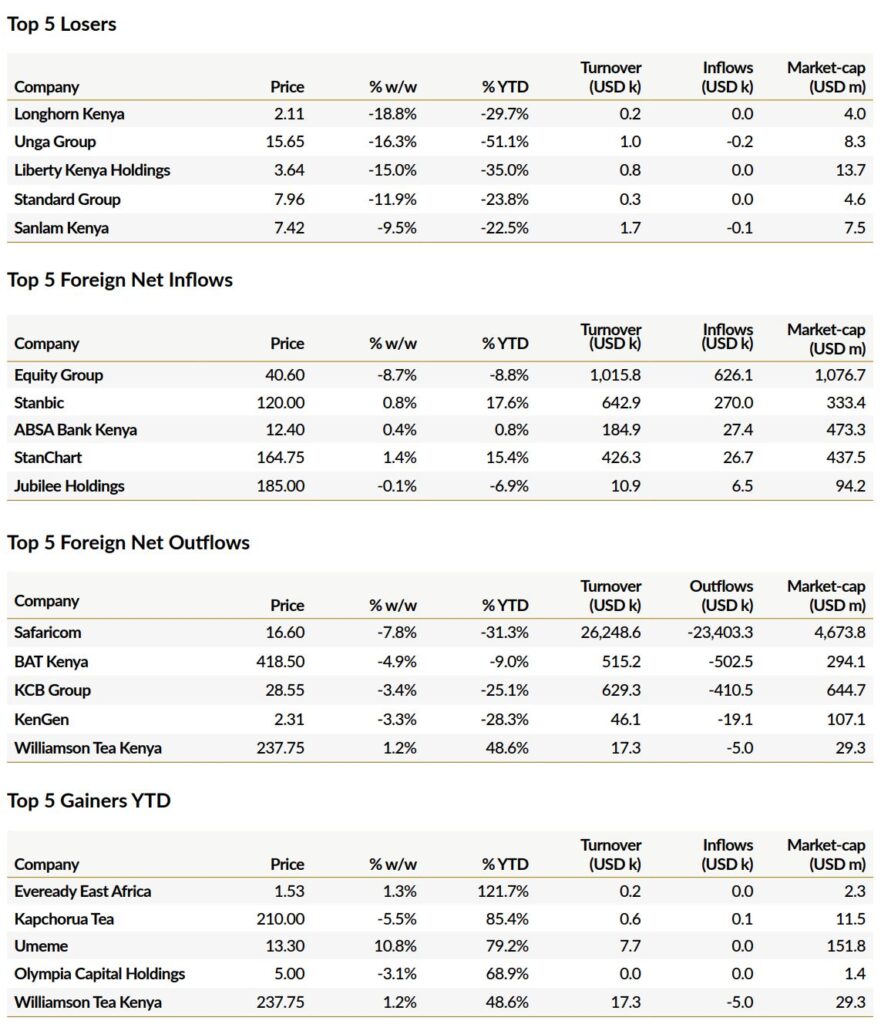

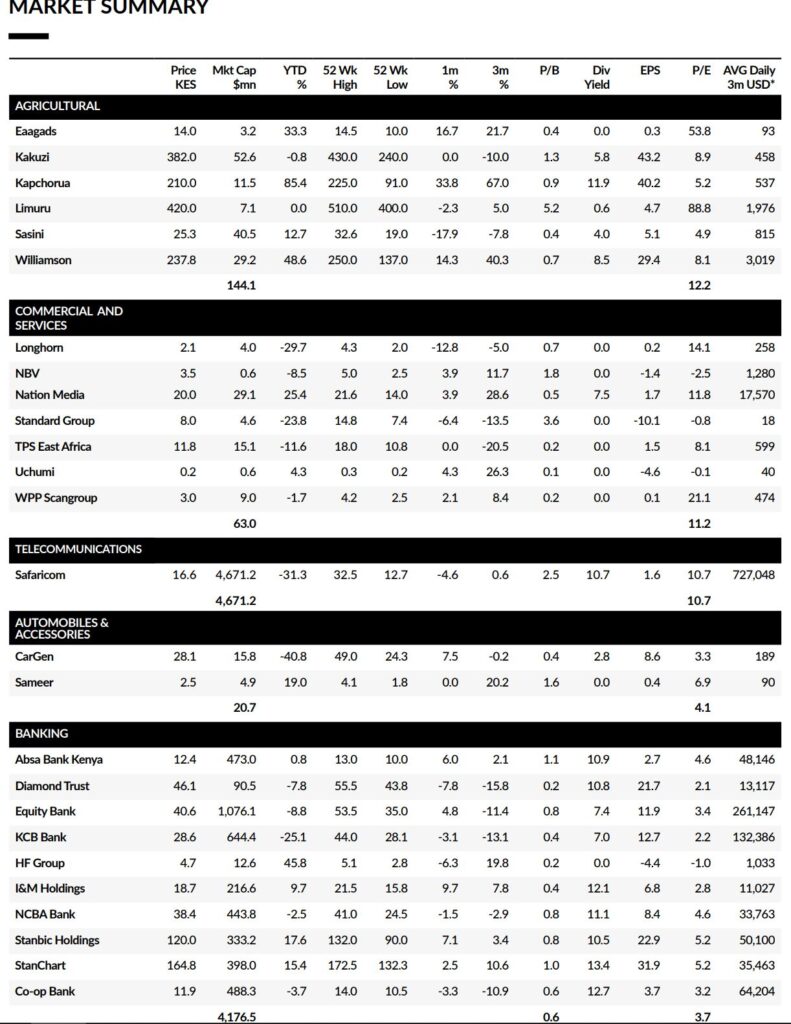

• The benchmark indices sustained their downward trajectory, with the NASI, NSE 20 and NSE 25 declining 4.8%w/w,

2.2%w/w and 4.4%w/w respectively on the price drop of most large caps.

• Market activity surged five-fold to USD 30.4m – highest in four months on bulk trading of Safaricom. The telco accounted

for 86.3% of equity turnover. Despite this, the firm maintained its two-week bear run, losing 7.8%w/w to KES 16.60 on

increased foreign selling. A record 208.5m shares of Safaricom were traded last Friday – the highest in recent memory, with

the counter leading the selling charge.

• Equity Group was the subsequent top mover at 3.3% of turnover. The lender slumped 8.7%w/w to KES 40.60 on local

selling. However, the lender led on foreign net inflows. Stanbic Bank was the only top mover to gain, rebounding 0.8%w/w

to KES 120.00. Investors are likely betting on the resumption of an interim dividend with the bank’s 1H23 results set to be

announced on 10th August 2023.

• Similarly, KCB and BAT sustained their two and three-week slides, shedding 3.4%w/w to KES 28.55 and 4.9%w/w to KES

418.50 respectively, each touching two-month lows on bearish foreign sentiments.

• Umeme was the leading gainer of the week, soaring 10.8%w/w to KES 13.30 while Longhorn was the leading loser,

plummeting 18.8%w/w to KES 2.11.

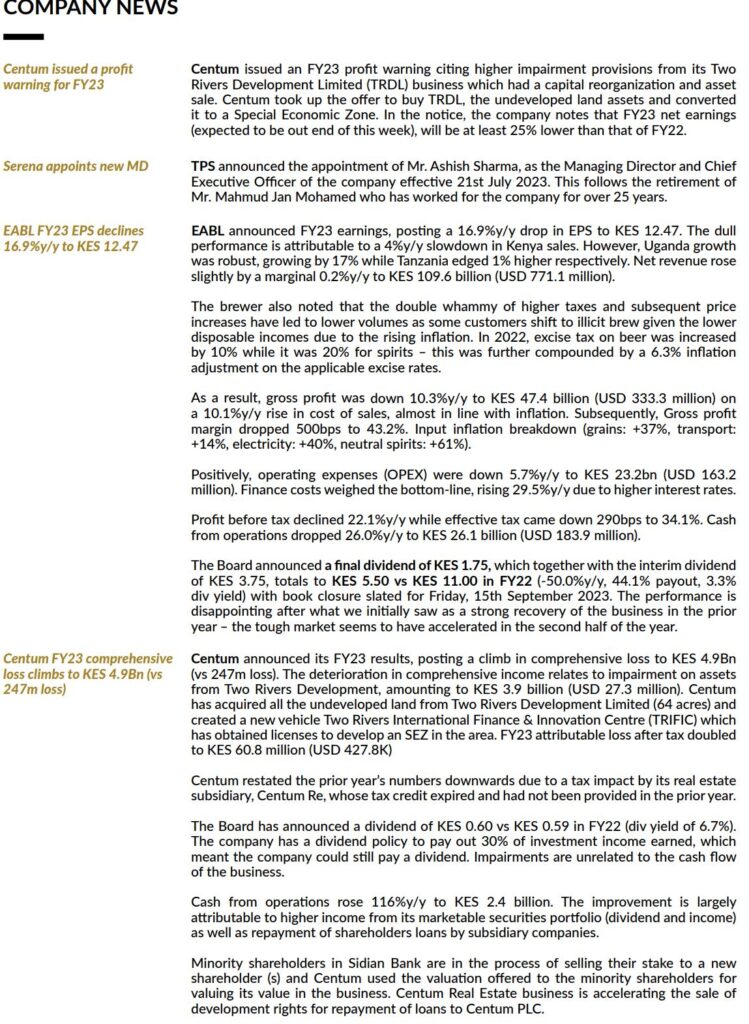

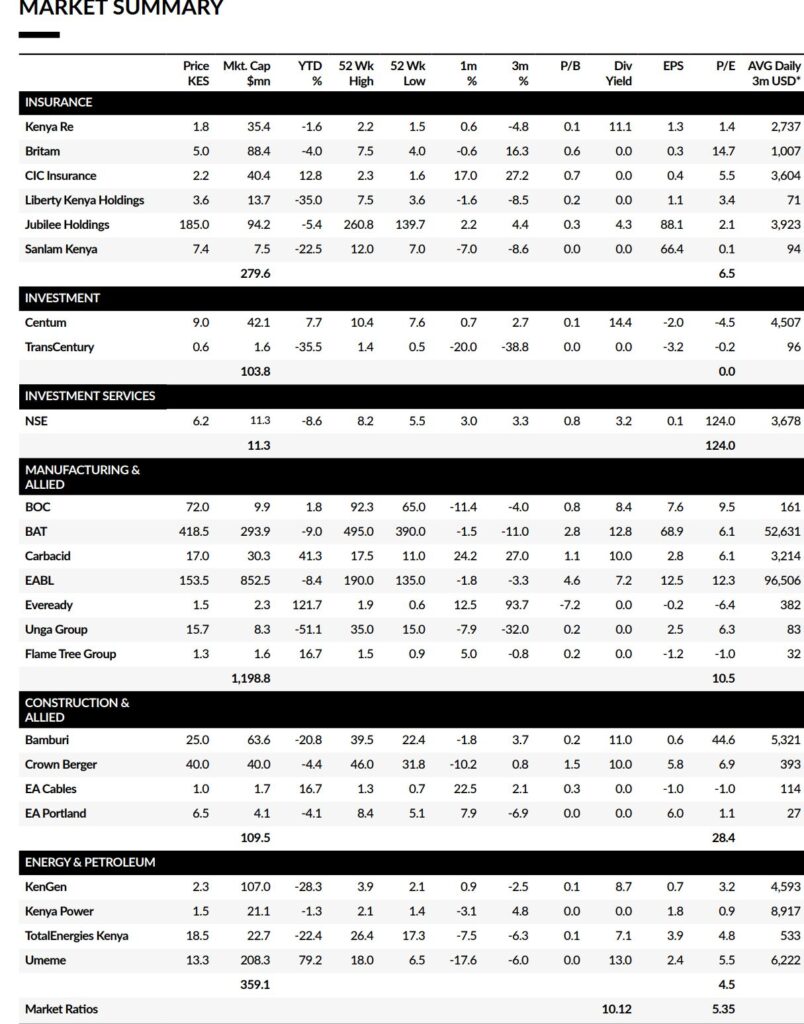

• Last week, Centum issued a profit warning, Centum Investment Company’s FY23 comprehensive loss widened to KES

4.9bn, EABL posted a 16.9%y/y drop in EPS, Serena appointed a new MD and the Court of appeal lifted orders which had

suspended the implementation of the Finance Act.

• Foreign investors turned net sellers following six consecutive sessions of net buying, registering the highest net outflows in

over five years of USD 23.4m. Safaricom led the selling charge while Equity Group led the buying charge. Foreign investor

participation rose to 49.3% relative to 42.3% in the previous week.

• This week, Kenya July inflation figures are expected today.