Kenya Weekly Market Wrap

“In contrast to the previous week, all the benchmark indices closed in the green. The NSE 20 led the winning charge, notching

1.0% higher w/w on the price gain of most large caps as the NASI and NSE 25 regained 0.8%w/w and 0.7%w/w respectively.”

EQUITY MARKET COMMENTARY

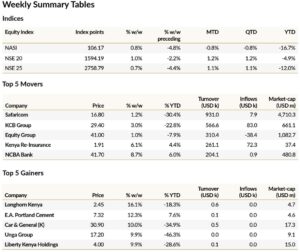

In contrast to the previous week, all the benchmark indices closed in the green. The NSE 20 led the winning charge, notching

1.0% higher w/w on the price gain of most large caps as the NASI and NSE 25 regained 0.8%w/w and 0.7%w/w respectively.

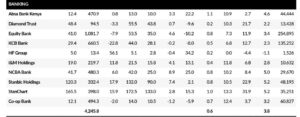

• Equity turnover slumped 90.4%w/w to KES 2.9m in the absence of last week’s bulk trades on Safaricom. Turnover at the

bourse touched an over 11-year low on Friday, likely on investor uncertainty over interest rate outlook (364-day T-bill

rose 0.4 percentage points w/w to 13.1%). The telco held the top mover position, accounting for 31.9% of trading activity,

followed by KCB at 19.4%. The former rebounded 1.2%w/w from its two-week bear run, closing at KES 16.80 on local

demand, while the latter recouped 3.0%w/w to KES 29.40 as local investors bought the dip.

• All the top movers closed in the green. NCBA was the best performer in the top movers’ list, recovering 8.7%w/w to a multi-

year high of KES 41.70 on bullish local sentiments. Kenya Re was a surprise top mover, jumping 6.1% to a two-month high

of KES 1.91 on increased foreign demand. Equity Group reversed losses, rising 1.0% to KES 41.00.

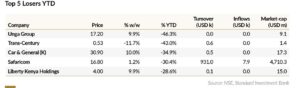

• Longhorn was the leading gainer of the week, soaring 16.1%w/w to KES 2.45 while Britam was the leading laggard,

plummeting 12.8% to KES 4.35.

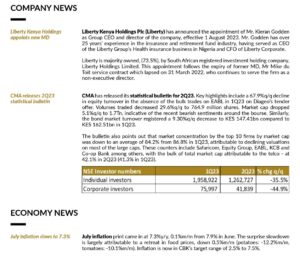

• Last week, Liberty Holdings appointed a new MD, CMA released its 2Q23 statistical bulletin, July inflation slowed to 7.3%

in July from 7.9% in June.

• Foreign investors turned net buyers, recording net inflows of USD 0.1m. KCB led the buying charge while Equity Group led

the selling charge. Foreign investor participation dropped to 42.6% vis-à-vis 49.3% in the prior week.

• This week, CBK MPC meeting on Wednesday, 9th August 2023. Stanbic 1H23 results to be released on Thursday, 10th

August 2023.