Trade and Financial Services Roundup: Issue 40 of 2024

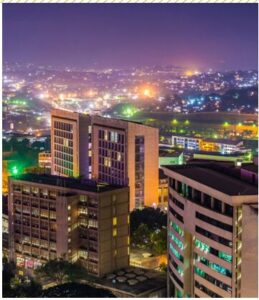

Kenya

Banks offered bond swap as KQ misses Ksh19bn loans deadline

Top commercial banks will convert Ksh19.3 billion ($149.9 million) worth of loans advanced to Kenya Airways (KQ) into Treasury bonds after the deadline for settling the debt lapsed. The 10 banks, including Equity, KCB and Cooperative Bank, own 38.1% of the airline. They have been offered a 6.5-year bond for an undisclosed interest rate, according to a Treasury document seen by the Business Daily. The Treasury, which has guaranteed the loan, had to settle the debt in cash by the end of August or issue the lenders an acceptable government security instrument or a bond.

(Business Daily)

Uganda

The quest for Ksh990b: Govt returns to debt market with longer-term bond offers

The government returns to the market to borrow. The instruments, a three-year bond with a yield or interest rate of 14.125%, a 10-year bond at 14.25%, and a 20-year bond at 15%, seek to raise Ksh230b, Ksh330b and Ksh430b, respectively. However, unlike in the September auction, the interest rates are lower, and the bonds have longer maturity.

The switch to longer-term bonds could indicate a desire to manage debt more sustainably, expectation of future rate increases, and confidence in the long-term prospects. It also suggests that the government wants to avoid the risks associated with short-term refinancing and lock in current rates for a longer period. Longer-term bonds measure investor confidence in economic stability over the long run. Bonds that carry longer-term maturing are subjected to lower taxes than shorter ones.

In August 2024, the government raised a total of Ksh2.6 trillion by issuing both short and long-term securities. Ksh1.29 trillion was collected from short-term securities, while Ksh1.3 trillion was mobilised from long-term government debt. Out of the total funds raised, Ksh2.03 trillion was used to pay existing treasury instruments that had matured – otherwise known as refinancing – while the balance of Ksh560.9b was allocated to finance other the budget. As Uganda navigates fiscal challenges, domestic borrowing remains crucial, especially following setbacks in external funding.

(Daily Monitor)

Tanzania

Tanzania’s LNG project

Tanzania is nearing the conclusion of negotiations on the liquefied natural gas (LNG) project. The government remains optimistic about finalising the Host Government Agreement (HGA) for its proposed LNG project before the end of the year.

This project aims to commercialise huge natural gas discoveries made in the deep offshore basin between 2010 and 2015 from Blocks 1, 2 and 4, amounting to 47.13 trillion cubic feet of natural gas. Shell Exploration and Production Tanzania LTD (Shell) made the natural gas discoveries in Blocks 1 and 4 with its partners Ophir and Pavilion. Equinor Tanzania AS (Equinor), with partner ExxonMobil, made natural gas discoveries in Block 2. Once the negotiations between the Government of Tanzania and the international oil companies are completed, the LNG processing and liquefaction facilities will be constructed onshore in Likong’o – Lindi region in Tanzania.

The project will involve drilling development wells in deep offshore fields, construction of subsea pipelines from deep offshore fields that will transport natural gas onshore for processing, construction of an LNG plant, and development of jetty loading facilities in the project area. Upon its completion, the LNG project will change discovered natural gas into liquid form for export to the world markets in Asia and Europe. The LNG project will also allocate natural gas for domestic use in power generation, industries, institutions, households, and Compressed Natural Gas (CNG) vehicles.

(The Citizen)

Ethiopia

Ethiopia

Ethiopia, World Bank sign agreement of USD70m for governance modernisation project

Ethiopia’s Ministry of Finance and the World Bank have signed a financing agreement for the implementation of the Governance Modernization to Enable Efficient Service Delivery Project amounting to USD70 million in the form of a concessional loan.

The project is keen on enhancing ongoing efforts to enhance the government’s capacity to mobilise and manage its financial and human resources.

The agreement was signed virtually by the Minister of Finance, representing the Government of Ethiopia, and Maryam Salim, the new Country Director for Ethiopia, according to the Finance Ministry.

(Ethiopia News Agency)

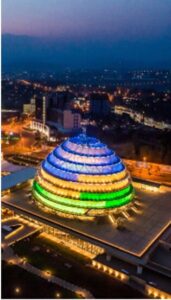

Rwanda

New governance rules mandate ESG integration

Rwanda’s new corporate governance code, recently launched by Rwanda’s Capital Markets Authority (CMA), mandates that listed companies and securities issuers establish systems to mitigate and manage environmental and social risks.

The new code encompasses environmental, social, and governance (ESG) principles, a set of rules requiring companies to be transparent, responsible, and conscious of their impact on the environment and society.

(The New Times)

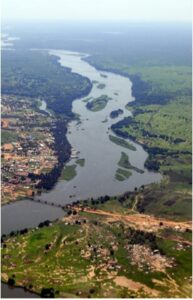

South Sudan

IMF completes mission to South Sudan for third review of staff-monitored programme

The IMF’s findings highlight that South Sudan continues to grapple with significant economic difficulties exacerbated by external factors, including the spillover effects of the ongoing war in neighbouring Sudan and recurrent flooding that have severely impacted economic and social outcomes. The South Sudanese authorities are working on a policy and reform agenda aimed at recalibrating macroeconomic policies to cope with the ongoing oil production shock while maintaining economic stability and debt sustainability. This includes adjustments to fiscal, monetary, and exchange rate policies.

(Capital)