Trade and Financial Service Round-Up: Issue No. 11 of 2025

Kenya

Why Banks Are Seeking Overhaul of Loan Pricing Models

Banks are in talks with the Central Bank of Kenya (CBK) for an overhaul of their loan pricing models amid concerns that they are not cutting interest rates in line with the reducing Central Bank Rate (CBR). The banks have sent a proposal for new loan pricing models to CBK, stating that the current models are quite rigid and do not have room for downward adjustment once enforcement begins. This proposal comes during the transition period in which banks have been mandated to change from risk-based lending. This is where banks had the flexibility to charge customers rates based on risk profile and add in their margin. This has proved difficult for lenders to quickly adjust the pricing of loans when CBR changes.

(Business Daily)

World Bank Approves $200 Million To Enhance Dodoma’s Mobility And Create Jobs

The World Bank has approved a $200 million (about Tshs. 520 billion) investment to enhance urban mobility and accessibility in Tanzania’s capital Dodoma. The Dodoma Integrated and Sustainable Transport (DIST) project aims to unlock economic opportunities, create jobs by 2030, and boost the city’s economic output by 2%. The World Bank Director for the region, Nathan Belete, states that the project will improve urban mobility by upgrading key transport corridors, access routes, and CBD infrastructure. DIST will be managed by the Tanzania National Roads Agency (Tanroads), Tanzania Rural and Urban Roads Agency (Tarura) City Council of Dodoma (CCD), and the Land Transport Regulatory Authority (Latra). The project will also be in partnership with the Korea Green Growth Trust Fund, the Global Facility for Disaster Risk Reduction and Recovery(GFDRR), and the Japan-World Bank Programme for Mainstreaming Disaster Risk Management(DRM)

(The Citizen)

Uganda

Uganda

Insurance Companies Should Lead Energy Transition

Members of the Insurance Consortium will play a significant role in Uganda’s energy transition agenda. The IRA stated that the Insurance Consortium for Oil and Gas Uganda has contributed to premium generation and risk retention. The same has been on the decline since 2024 by about 82%. This, however, has begun turning around in 2025 with a recovery of $1.75 million and Ush. 6.56 billion in premiums. Insurance is critical in risk mitigation, environmental protection, ensuring financial stability, and regulatory compliance. In addition, given the shift towards renewable energy, there is a need for new products tailored to green energy, carbon capture, and clean technology. The IRA is currently engaged in the Tilenga, Kingfisher, and East African Crude Oil Pipeline fields and is optimistic for more.

(The Monitor)

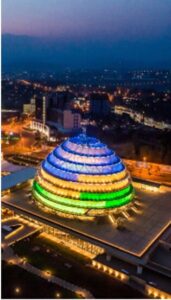

Rwanda

Rwanda

National Land System to Integrate Financial Management Information

The National Land Authority has announced a major integration of the Financial Management Information System (FMIS) into the Land Administration Information System (LAIS). The LAIS is a digital land registry for managing land ownership records, transactions, and land use information. The system ensures efficiency, transparency, and security tenure. This strategy seeks to streamline service delivery, enhance compatibility with financial systems, and boost operational efficiency. The National Land Authority guarantees that the FMIS expropriated lands are automatically registered to the government upon payment. Effectively, eliminating bureaucratic delays and preventing tax miscalculations on properties no longer owned by private individuals. The LAIS upgrade represents a major step toward a more efficient, transparent, and technologically advanced land management system in Rwanda.

(The New Times)

Ethiopia

Ethio Telecom, Mastercard Join Forces to Advance Digital Financial Services in Ethiopia

The CEOs of Ethio Telecom and MasterCard held a strategic meeting focused on collaborative opportunities to leverage technology and enhance digital financial services across Ethiopia. The same aims to expand financial inclusion and promote sustainable growth.

(ENA)

Somalia

Somalia joins Afreximbank as it seeks to boost Intra- African Trade and Economic Growth

Somalia has joined Afreximbank as the 53rd African state of the multilateral financial institution. This acceptance is one step closer to the Bank’s goal of expanding the products it offers to all parties on the continent. On the other hand, this is a step for Somalia in its journey to explore its options regarding development and boosting its economy.

(Afreximbank)