Parliamentary Aisle![]()

Senate Sets December Hearings in Nyamira Governor Impeachment Case

The Senate has set out a timeline for the impeachment proceedings against Nyamira Governor Amos Nyaribo. All parties are required to file their written responses by Monday, 1st December 2025, at 5:00 p.m. The compiled documents and the official hearing programme will then be circulated to all Senators by Tuesday, 2nd December 2025, at 5:00 p.m. to guide the upcoming sessions. The impeachment hearings themselves are scheduled to take place on Wednesday, 3rd December and Thursday, 4th December 2025. The Senators will hear evidence, interrogate witnesses, and deliberate on whether to remove the Governor from office. Nyaribo’s impeachment stems from allegations laid out by the Nyamira County Assembly, including gross misconduct, abuse of office, irregular appointments, and mismanagement of public funds.

Corridors ofJustice![]()

ACA Chair Faces Bribery Charges

The Anti-Counterfeit Authority (ACA) chairperson, Josphat Gichunge Kabeabea, is facing formal bribery charges after the Ethics and Anti-Corruption Commission (EACC) raided his home and offices. The allegations claim that on 11 November 2025, he demanded and later received money from a Chinese investor in exchange for blocking prosecution for purported dealings in counterfeit auto parts. The file was forwarded to the Directorate of Public Prosecutions (DPP), which has approved charges under the Anti-Bribery Act, 2023 and related legislation, marking a significant step in the prosecution process. The case is now before the Milimani Anti-Corruption Court and has been scheduled for mention on 8 December 2025 for further directions.

Talking of Which![]()

CBK to Roll Out New Credit Pricing Framework

On December 1, 2025, the Central Bank of Kenya will begin implementing its revised Risk-Based Credit Pricing Model. This marks a major shift in how banks calculate lending rates. All new variable-rate loans will be priced using KESONIA, the Kenya Shilling Overnight Interbank Average. Additionally, a bank-specific premium will be used, replacing the previous CBR-anchored approach. This change introduces a market-based benchmark designed to improve transparency, align pricing with actual funding costs, and strengthen consumer protection. Banks will now be required to disclose the full cost of credit more clearly and publish their lending rates and fees on the Total Cost of Credit website, signalling a tighter regulatory environment and a more transparent credit market moving forward.

Watch out for![]()

Deadline for Submissions on Constitution Amendment Bill

The Senate has set Friday, 5th December 2025, as the deadline for members of the public to submit written memoranda on the Constitution of Kenya (Amendment) Bill, 2025, ahead of the Committee’s report to the House. The Bill, which seeks to address structural and governance gaps in the current constitutional framework, was committed to the Standing Committee on Justice, Legal Affairs and Human Rights after its First Reading on 7th August 2025. As part of the public participation process, the Committee will also hold a public hearing on Monday, 6th October 2025, at the Busia Agricultural Training Centre starting at 9:00 a.m. Citizens are invited to attend the hearing or submit their views in writing to the Clerk of the Senate before the deadline, with all Bill documents accessible on the Parliament website.

MovingUp![]()

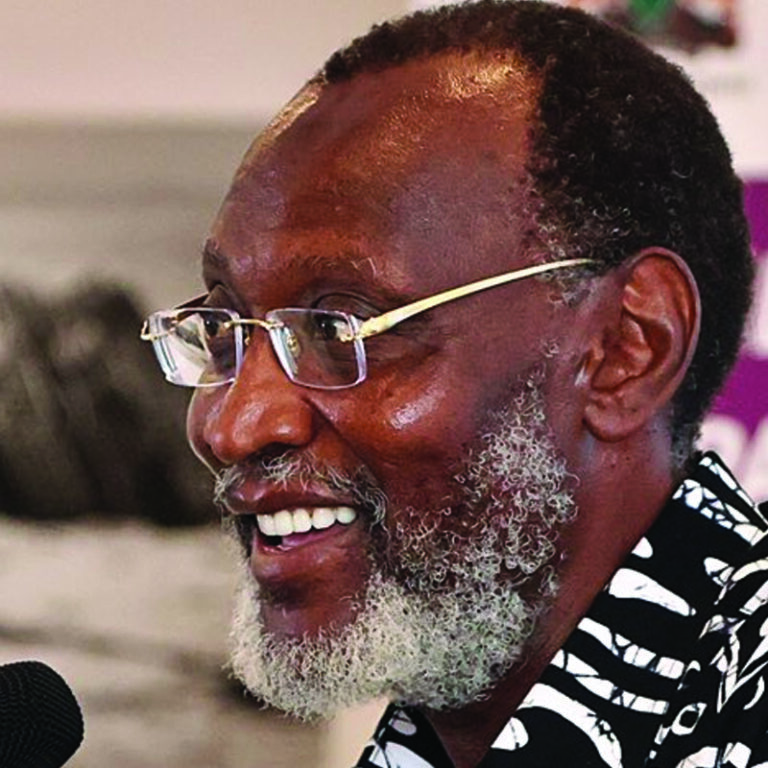

Muhoho Kenyatta - Non-Executive Director at NCBA Group

Muhoho Kenyatta has been appointed as a Non-Executive Director of NCBA Group, effective December 1, 2025. He brings over 35 years of leadership and governance experience across manufacturing, healthcare, insurance, and banking. Kenyatta has served on the boards of key national institutions, including the Kenya Association of Manufacturers, the Kenya Private Sector Alliance (KEPSA), the Kenya Dairy Board, and the Kenya Shippers Council. He previously held several senior governance roles within NCBA and its predecessor entities. Most notably, he served as Deputy Chairman from 2000 to 2019 and as a director at NCBA Bank Uganda. He has also contributed to the Group’s digital transformation efforts through his role on the board of LOOP DFS Limited. He holds a Bachelor’s degree from Williams College and an Advanced Management Certification jointly offered by IESE Business School and Strathmore Business School, complemented by various executive leadership and governance programs. His appointment comes amid heightened investor attention driven by ongoing merger discussions with Standard Bank Group.