‘Stolen/missing’ title deeds and mitigating the risks associated with their loss or mishandling

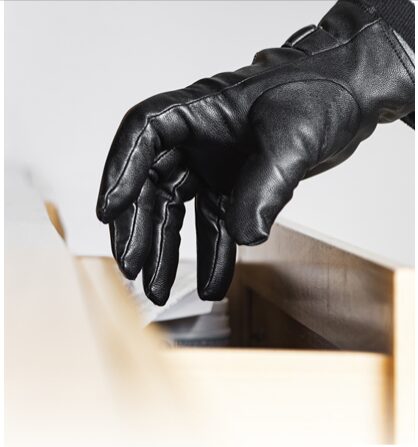

On Saturday, the Government Printer informed the public about the theft of 307 title deeds. However, the government has since clarified that no title deeds were stolen from the Government Printer, contrary to what was implied in a gazette notice dated September 26, 2024, issued by the State Printer. While making the announcement, the government distanced itself from the incident and clarified that it would not take any liability arising from any unauthorised transactions that led to the loss of the said documents.

The news quickly went viral, with many Kenyans sharing the update on social media, sparking panic as thousands rushed to check if their land documents were among those reported missing. In response, the Ministry of Lands, Public Works, Housing, and Urban Development issued a statement clarifying that the stolen items were not actual title deeds but rather the security paper used for printing them. These papers, which contain security features used exclusively for title deed printing, are only available at the Government Printer. The Ministry believes the theft was intended to produce fake title deeds for fraudulent purposes.

This takes us back to the steps that the government has been taking to protect title deeds amidst the numerous land-grabbing and fraud cases that had riddled the Lands Ministry. The promulgation of the Land Registration Act, 2012 sought to rationalise and consolidate the different land registration regimes into one uniform registration system.

This saw the creation of the Ardhisasa platform, a significant step towards preventing fraud, through which land transactions, previously done manually, could be made online. This was to cure the fraud and manipulation of land documents at state offices that had created a crisis that had seen many rightful landowners lose valuable property to unscrupulous individuals well-connected to government officials working in the lands’ ministry.

In essence, the platform acts as a one-stop shop for several land transactions, including conducting land searches, registering leases and cautions, and replacing titles. Stakeholders also use the platform to extend or renew leases, change users, issue certificates of compliance, conduct asset valuations, and administer estates.

As we discuss all this, it is also essential to look at the role banks play in the handling of title deeds, especially in relation to property financing, storage, and collateral management. This is a critical safeguard for banks, as they ensure they have a legal claim to the property if borrowers default on the loans. In such cases, banks retain the original title deeds for the duration of the loans as a form of security. The property owners cannot transfer, sell, or use the properties for another financial transaction without the banks’ consent. In addition to title deeds held for loan security, some clients may choose to store their title deeds in bank deposit boxes for personal safekeeping.

This is particularly common when individuals do not trust home storage due to theft or fire risks. A crucial concern arises when stolen title deeds are used as collateral for loans or stored in bank vaults. While banks are typically not complicit in knowingly holding stolen title deeds, they have a responsibility to ensure the legitimacy of all documents submitted to them.

Mitigating the risks associated with losing or mishandling title deeds

In light of all these, the Law Society of Kenya Nairobi Branch issued a press statement on the risks posed by the lost paper title deeds. The government, property owners, and banks must take proactive measures that strengthen security, improve oversight, and enhance digital processes.

The introduction of the Ardhisasa electronic platform is a step in the right direction, but the Government should continue pushing towards the use of electronic titles as a standard. Owners should regularly verify that their land ownership details are accurately reflected in the government’s digital registry.

Additionally, establishing a blockchain-based digital ledger would offer a transparent record of land transactions and ensure that lost or stolen title deeds can be flagged immediately. Moreover, the integration of secure QR codes on physical titles linked to the government’s digital registry would allow verification of a title’s authenticity in real time during property transactions.

Implementing Radio Frequency Identification (RFID) technology and geofencing around areas where title deeds are printed or stored would enable real-time tracking and monitoring of title deed papers. Additionally, strict access control measures, such as biometric systems and CCTV surveillance in printing and storage areas, can limit unauthorised access. Public awareness and training for land officers, advocates, and property owners are also essential. Regular training sessions on how to detect fraudulent titles and verify title deed papers are also crucial.

To mitigate risks, banks should conduct thorough due diligence before accepting title deeds as collateral. They should also regularly audit the title deeds they store to ensure they are correctly accounted for.

Through a combination of digitisation, secure storage, vigilant oversight, and robust legal frameworks, the government, property owners, and banks can collectively minimise the risks associated with title deed loss and prevent fraudulent activities.