Rise of sustainable funds: Powering the journey towards sustainable development amid challenges

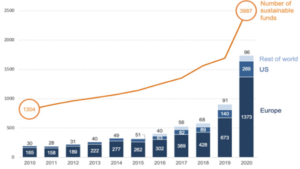

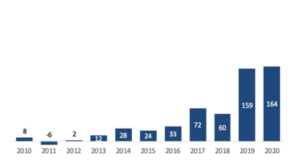

Sustainable funds, including mutual funds and exchange-traded funds (ETFs), have seen a significant rise in recent years. Sustainable funds have integrated sustainable development considerations into their investment strategies, contributing to sectors that align with the Sustainable Development Goals (SDGs) set by the United Nations. The number of sustainable investment funds has nearly doubled in the last five years, reaching 3,987 by June 2020. The assets under management (AUM) of these funds have exceeded $1.7 trillion, accounting for just over 3% of the assets of the world’s open-ended funds.

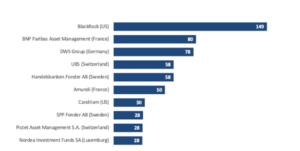

The sustainable fund universe is diverse, comprising 3,435 sustainable mutual funds and 552 sustainable ETFs. These funds collectively manage assets worth $1.56 trillion and $174 billion, respectively. However, the majority of these funds are domiciled in developed countries, particularly in Europe, and primarily target developed regions for their portfolio selection. Developing and transition economies host about 5% of the world’s sustainable funds by number and less than 3% by assets.

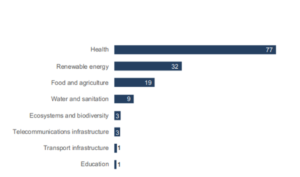

On average, sustainable funds have deployed 27% of their assets across eight key SDG sectors, including health, renewable energy, and infrastructure. However, there is a wide variance in sustainability ratings among funds, suggesting that a significant proportion of underperforming funds may not meet their sustainable credentials. This calls for more robust and standardised sustainability ratings and benchmarks.

Despite the impressive growth, the sustainable fund market faces several challenges. There is a risk of it remaining a niche market, given the geographical imbalance in the distribution of funds and the sustainability washing concerns. To overcome these challenges, regulators and the fund industry in both developed and developing countries need to take proactive measures. These measures should aim to support the growth of sustainable funds both domiciled in and with a portfolio exposure to developing countries.

Conclusively, the sustainable fund market has evolved significantly over the years, playing a pivotal role in financing sustainable development and contributing to the attainment of the SDGs. However, to ensure the further expansion of this market and its alignment with the SDGs, it is imperative to address the existing challenges. The journey of sustainable fund markets is far from over; it is a continuous process of growth and evolution towards a more sustainable and equitable world. It may be interesting to see how the sustainable fund markets can interact in the Kenyan space.