Rearranging the payment systems landscape: Exploring how banks and telecoms can deeply disrupt payment systems

The Central Bank of Kenya (CBK), on Wednesday, May 4, 2023, launched the Kenya QR Code Standard, in an event that was graced by leading players in the telecom and banking sectors. The implication is that going forward, payment service providers like Safaricom, alongside leading banks such as KCB will issue merchants with QR codes that virtually accept digital payments. These QR codes will contain information such as the name of the business, and the amount due, allowing customers to scan the codes through the payment service provider apps and mobile banking applications in order to make payments.

This is a welcome move but the payment systems surface is yet to be fully scratched. On introspection, the fundamental question of the future of payment systems in Kenya begs that, with a clear picture of the future prospects of payment systems in Kenya, what possible measures can be taken by banks and telcos to effectively shuffle and navigate the payment systems chessboard?

Covid-19, technology and the paradigm shift

The unprecedented Covid-19 pandemic may have had damaging effects on all facets of human life and activity. On the flip side, the pandemic was also a great eye-opener on so many things, and of concern here is trade and commerce. With the limitations it brought on physical human interaction and activity, there arose a need to rejig and recalibrate approaches to many things including commerce and trade.

While before the pandemic there were shifts in how people paid for goods and services, the post-pandemic period propelled by innovation and technology, saw a dramatic shift in how people pay for goods and services. As a result, there is a great appreciation of electronic-based payment methods, with paper-based cash being displaced more or less. Further to it, and more recently, cryptocurrency and digital currencies are now emerging as alternatives to traditional conceptions of money.

With the advancement of technology and increased appreciation of limited physical human interaction, e-commerce has become the ‘new normal’. It is against this backdrop that there is an increased clamour for more efficient media of exchange. Consequently, entities are increasingly appreciating new and novel payment systems, more so those that are premised on technology, in order to navigate this ‘new normal’. It therefore remains a pressing need, now more than ever, for players in the financial systems field, to initiate steps of navigating the payment systems matrix amidst increased evolution and revolution.

Increased growth prospects

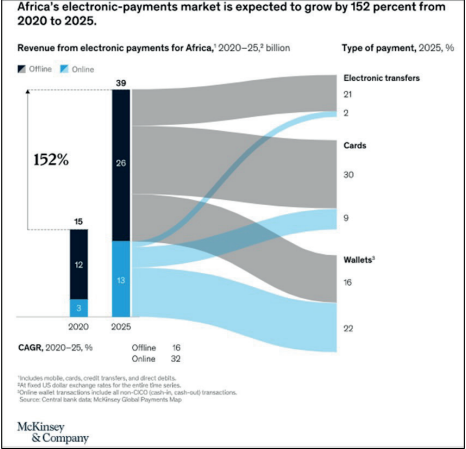

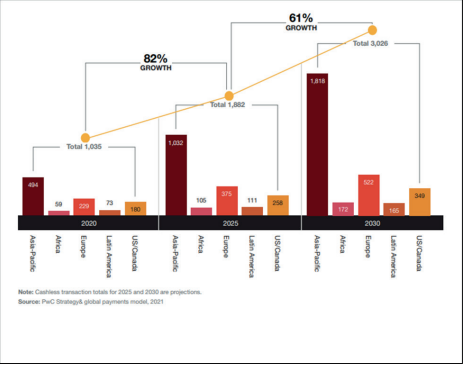

According to a study by McKinsey, the shift to e-payments and tech-based payment systems will not only endure but also exhibit accelerated growth. Overall, the McKinsey study anticipates that between 2020 and 2025, there will be an approximately 150 percent growth in the e-payments market. Translating this into revenue numbers imply that revenues will clock almost $40 billion from domestic payments alone, with about 188 billion in transaction volumes. (See Figures. 1 and 2 below).

This growth is anticipated to be uneven and will be determined by the steps taken by a country with regard to infrastructure readiness, e-commerce penetration, mobile-money penetration, and regulation, among other factors. Countries, notably Kenya, Ghana, Egypt, Nigeria and South Africa have evidently approached the transition to digital payment systems faster, and as a result, are rapidly developing or have rapidly developed on this front having put in place appropriate infrastructure and relevant policy frameworks to deliver a sophisticated electronic-payments system. The likelihood is that around half of future electronic payments revenue will come from these five countries, with the fastest growth in Nigeria, at 35 percent per year. Other countries that will see strong growth above 20 percent per year include Ghana, Ivory Coast Kenya, Senegal, and Uganda.

Figure 1: Electronic Payments Growth Projections, McKinsey, 2021

Figure 2: Cashless Transactions Totals and Projections, PWC

Factors for Growth

The future of payment systems in Kenya and Africa from a general scope is being shaped by a number of factors. These factors include (a) favourable demographics, (b) economic growth (c) innovation and technology and (d) advancements in payments infrastructure. An additional factor that is likely to spur the growth of payment systems is the impact of newer disruptions such as digital currencies and open banking, although this is hard to predict and forecast.

Moreover, young and urbanised consumers provide a fertile ground for growth. The African growth rate, pencilled at 2.7 percent per year, is the fastest rate globally compared to the global rate of 1 percent. The implication is that the population of young people in Africa, which is already high, will still grow in bounds and leaps. This young population is also likely to be staying in cities by 2045. This population will provide a ready market for e-payments, and this has already been witnessed with an increased shift in how urban dwellers transport themselves (e-cab hailing services), consume entertainment (streaming options) and shop for goods and services (e-commerce).

A picture of the future

The payments mix in Kenya is already evolving rapidly. This was in fact evidenced by the launch of the QR Standard Code. The fact that countries are embracing methods of payment that do not revolve around the traditional cash-based system, supported by technology and the existence of a vibrant youthful generation to provide a market for these methods, paints a luminous picture for the future. Indeed, this is an enormous opportunity that corporates need to appreciate and slice as they strive to stay afloat as a matter of growing concern.

The payments matrix is increasingly undergoing a reshaping. This reshaping revolves around two parallel fronts — evolution and revolution. On the evolution front, there are massive transformational changes that are causing shifts in both the front and back-end components of the payment system. As for revolution, changes in the form of huge structural changes to the payment matrix and ecosystem are also coming up.

Consequently, both evolution and revolution are causing seismic changes across the globe, in different ways and at different paces. The end result is a creation of a payment matrix that is complex but effective when properly harnessed. The buck, therefore, stops with entities to figure out where and how to play, within the matrix, and eventually win.

Takeaways

While Kenya has taken tremendous steps in taking advantage of innovation to pursue developments in its payment matrix, and the launch of the QR Code Standard speaks to this, this is barely a scratch of the surface. There are numerous opportunities that players can pursue to get to the core of the matrix. In the course of this exploration, it is fundamental that players remain open to gaps in existing systems and take steps to close them, even as they continue scratching the payment matrix surface.

There are opportunities for players, majorly banks and telcos involved in the financial systems arena. To adequately maximise and optimise these opportunities, players need to put in steps that respond to the complexities of the payments’ systems matrix.

For banks, they need to:

(a) Leverage their existing infrastructure and networks to bring in the offline payments market, to expand the scale and enhance efficiency;

(b) Embed finance by integrating lending and other services into customer experiences and journeys, which would enhance distribution and access;

(c) Make payments a service, reposition its capabilities, design and services as an integrated launchpad and platform for growth;

(d) Design ecosystems that support customer transaction and participation across all facets;

For telcos, they need to:

(a) Reposition their market platforms and open distribution channels;

(b) Support and speed up investments in innovation, improve customer experience, and put in place measures to support migration of online customer bases into the online and digital channels;

(c) Data is the next minefield, and as such entities need to monetize data;

(d) Explore how to build on cross-border remittances and partnerships.