Kenya’s Economic Freedom Ranking: A Look at the 30th Anniversary Index Results

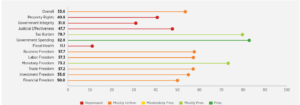

This year marks the 30th anniversary of the Index of Economic Freedom. Kenya holds the 20th position in Africa and ranks 120th globally, categorised as ‘mostly unfree’. The score falls above the continent’s average but below the global average, as shown in the following image.

Source: Index of Economic Freedom Website at https://www.heritage.org/index/pages/country-pages/kenya

The index evaluates countries based on 12 key qualitative and quantitative categories, including property rights, judicial effectiveness, government integrity, tax burden, government spending, fiscal health, business freedom, labour freedom, monetary freedom, trade freedom, investment freedom, and financial freedom. These categories serve as indicators to assess the presence of the rule of law (property rights, judicial effectiveness, and government integrity), government size (tax burden, government spending, and fiscal health), regulatory effectiveness (business freedom, labour freedom, and monetary freedom), and market openness (trade freedom, investment freedom, and financial freedom) within a country’s economy.

In an analysis of Kenya’s poor performance in the report released in February this year, Kenya’s lowest score was in fiscal health, where it garnered 11.1 points, followed by government integrity at 31.0 points. However, the country performed best in government spending, tax burden and monetary freedom at 82.8, 79.7 and 73.2 points, respectively.

Source: Index of Economic Freedom Website at https://www.heritage.org/index/pages/country-pages/kenya

Under the Rule of Law category, Kenya scores poorly with all the indicators here falling below the world average. Under government size, the fiscal health indicator performs poorly due to the budget deficit and growing debt burden. As reported in the Medium-Term Revenue Strategy, Kenya is at risk of debt distress in case of global shocks, as acknowledged by the government. The country also faces a budget deficit that needs to be reduced to the East African Community (EAC) regional target of 3% of GDP. The Kenyan government intends to achieve this target in the medium term. However, the country performs well in the indicators of tax burden and government spending. This is unsurprising, given that Kenya is currently on a fiscal austerity trajectory and is targeting a primary budget surplus. In the 2024 Medium Debt Management Strategy, the fiscal deficit target for the medium term was approved and set to 3.9% of GDP for FY 2024/25 with a forecast of 3.3% of GDP for FY 2026/27, in line with the fiscal consolidation path while the country’s borrowing strategy was approved at 55 percent (+5) for net external borrowing and 45 percent for net domestic borrowing. This is a big improvement from other years.

Under regulatory efficiency, Kenya performs moderately due to an inefficient regulatory environment. The indicator business freedom scores below the world average, bringing down performance on this front. Under the category of open markets, all indicators perform moderately.

What is clear is that Kenya needs to improve its rule of law and fiscal health to bring them up to acceptable levels.