Kenya’s debt challenge and the crucial role of the private sector

For economists, the private sector stands as a critical driver of economic growth. However, in Kenya, it has been stifled by policies hindering its potential. It is indeed disheartening that with the public sector already overburdened and overstretched, the requisite balance necessary to manage public sector and private sector demands has not been given the requisite attention. A robust private sector is key in meeting the demands of an economy including settling debt obligations.

President Ruto, on assuming office, vowed to tame the ballooning public debt. While detailing his plan for a “bottom-up” economic transformation model, he committed to slashing government debt and introducing policies putting money in the pockets of impoverished Kenyans. Fast forward, records from the National Treasury indicate that the country’s debt level has reached record highs despite the President’s vow to tame the country’s appetite for loans.

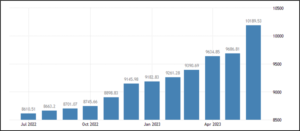

Recent data on public debt from the National Treasury indicate that the total public debt rose by a record KShs 1.56 trillion ($10.8 billion) in the financial year ended June 30 to 10.1 trillion shillings ($70.75 billion), breaching a debt ceiling of KShs 10 trillion (See Figure 1). The National Treasury attributed this increase in public debt to external loan disbursements, exchange rate fluctuations and the uptake of domestic and external debt.

Fig.1: The Central Bank of Kenya

Perhaps the question that lingers in the minds of Kenyans is, how do we get ourselves out of this conundrum? Simply put, a robust private sector is key to solving the country’s debt debacle. The private sector is a key contributor to the country’s tax revenues, a pivotal stakeholder in the economic undertones of a country, a principal job creator and overall, a major contributor to national income.

Despite the enormous potential of the sector, Kenya’s private sector is yet to fully realize its potential and contribute to the country’s development agenda as it should due to various challenges. Some of the challenges include insecurity, lack of collateral for credit and high taxes.

With the ballooning public debt, the country needs to reconsider its approaches towards the private sector. It is imperative that deliberate steps be taken to create an enabling business environment for the sector. A weak business environment results in a large informal economy characterised by low-pay, low-productivity jobs in firms that have limited access to finance, and limited growth prospects. This inevitably not only results in less inclusive economic benefits but also stretches the already burdened public sector.

It is not in doubt that improved macroeconomic policies are essential to create an enabling environment where private businesses can thrive and operate with confidence. Low inflation and less volatile economic growth create a more conducive environment for businesses and encourage them to invest and create jobs. Sound taxation, monetary, and prudent fiscal policies are essential in this regard.

The government has initiated steps to enhance the business environment, but red tape still remains an obstacle, hindering the private sector’s full potential.