ICDC gets a new lease of life: A sovereign wealth fund in the making?

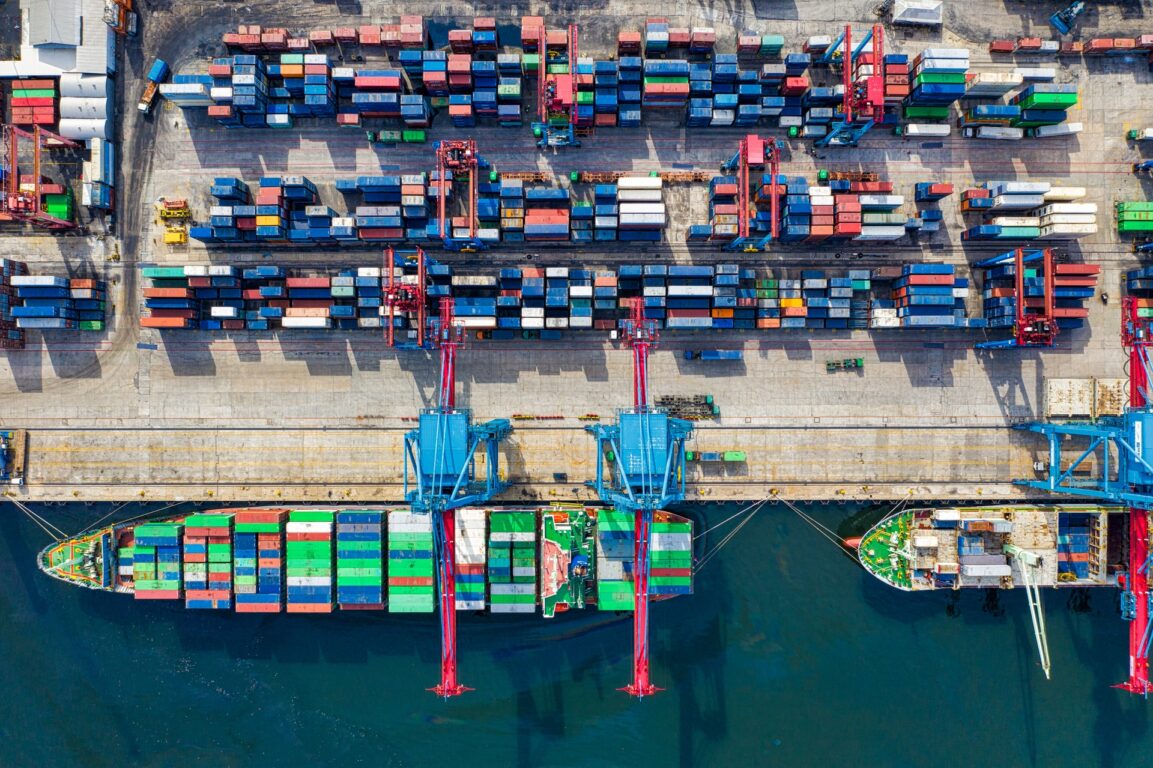

Earlier today through Executive Order number 5 of 2020 the President promulgated the new framework for the management, co-ordination and integration of public port, rail and pipeline services via the newly constituted Kenya Transport and Logistics Network (KTLN) which shall be coordinated by the Industrial & Commercial Development Corporation (ICDC). In the Executive Order the President seeks to boost the nation’s competitiveness in trade sector and in the ease of doing business guided through the implementation of the Big Four Agenda focus of the Third Medium Term Plan under vision 2030.

Specifically, ICDC on behalf of The National Treasury has been vested with the mandate of coordinating the management of the State’s investments in Ports, Rail and Pipeline Services to achieve synergy of the following state corporations; the Kenya Ports Authority (KPA), the Kenya Railways Corporation (KRC) and the Kenya Pipeline Company Limited (KPC). The above state corporations will get into a framework agreement to synchronize the implementation of their respective mandates and to establish a coordinated transport logistics network known as the Kenya Transport and Logistics Network (KTLN).

According to the Executive Order the Framework Agreement must be signed within 30 days and ICDC whose board is now chaired by John Ngumi shall be mandated with securing the achievement of the commercial vision and objects of the Agreement. KPA, KRC and KPC and ICDC have been vested in the National Treasury and their boards of directors of have been reconstituted with the appointment of a new “dream team” to facilitate the execution of the Kenya Transport and Logistics Network.

Through the new arrangement it is hoped that Kenya shall fulfill strategic agenda of becoming a regional transport hub through the provision of port, rail and pipeline infrastructure in a cost effective and efficient manner, and within acceptable shared benchmark standards in accordance with a press statement from State House also released earlier today.

ICDC rising from the ashes

ICDC, the Uchumi House based state agency was established in 1954 and at that time it was called IDC (Industrial Development Corporation). The entity was established with a noble aim of opening up the economy and placing it under indigenous hands following the end of colonial rule. ICDC was a co-investor with some of the country’s most prominent entities having historical ties to it including but not limited to:-

General Motors East Africa Limited, Centum Investments Company Limited, the now struggling Uchumi Supermarkets Limited, AON Insurance Brokers Limited, Eveready Batteries (E A) Limited, Kenya Wine Agencies Limited, Development Bank of Kenya Limited, IDB Capital Ltd, Kenya National Trading Corporation, Kenatco Taxis Limited, Agrochemical & Food Company Limited, East African Industries (Now Unilever (EA) Ltd), Firestone (E A) Ltd (Now Yana Tyres Ltd), Nairobi Airport Services (NAS) (now Servair-NAS Ltd), Dawa Pharmaceuticals Ltd, Pan African Paper Mills (EA) Ltd (Now Pan Paper Mills Ltd), and Rivatex Textiles Ltd among others.

Sixty-six years since its formation the ICDC has had its good and really bad days with the recent past being most difficult, where up until a few hours ago it was considered a largely defunct state investment agency.

There is an ongoing consolidation of state corporations with the effect of today’s executive order mirroring the proposed consolidation of airports and airline industry in Kenya through the National Aviation Management Bill, 2020. In this ongoing consolidation a key guide is the report of Presidential Taskforce on Parastatal Reform which recommended the reorganization and reform of the governance framework for overseeing and managing state-owned enterprises, assets and parastatals as stated it the Executive Order.

Kenya’s current credit ratings and the need for alternative government financing:

In May this year Kenya’s Moody’s outlook was adjusted from neutral to negative. The CBK Governor a week later explained that the rating was affirmed as B2 which is not a downgrade of the rating, while the adjustment of the outlook was moved from neutral to negative in the context of COVID-19. In mid-July 2020, Standard and Poor’s (S&P) downgraded Kenya’s sovereign credit outlook from stable to negative also due the negative effects of the COVID-19 pandemic. Kenya’s current debt to GDP ratio is about 62% and had been forecasted to reach 65% by the end of the year.

In October 2019, Kenya’s parliament approved an increase in debt ceiling through an amendment of the Public Finance Management Act that effectively allowed Kenya to borrow above the limit which stood at 50% of GDP.

Despite the increased ceiling, Kenya currently fails to make an attractive offering for investors and a realignment of national assets is the only way to create a fund that can be trillions in the making. If the country in its current asset structure cannot get favourable terms from the international market the only viable option is a strong sovereign wealth fund. The Kenyan government has stakes in a number of profitable entities which can be leveraged for more attractive borrowing in the international market.

If the National Treasury can successfully strengthen its internal capacity by securing the necessary technical skills and competencies needed to effectively oversee investment portfolio management as stated in today’s statement from State House then a case can be made for the consolidation of lucrative government assets under a sovereign wealth fund. Trillions in additional funding can be unlocked with the consolidation and optimization of other industries including the energy sector and the placement of government owned shares in profitable companies like Safaricom in the telco sector and its investments in the banking sector under one investment basket. A fine example is the Temasek Holdings from Singapore which today has a Moody’s AAA rating.

It is hoped that today’s changes carried out without amending the existing laws or causing undue disruption to the legal structuring of the State entities will secure comfort with the concept, and utilize the experience to guide the development of a more permanent legally structured organization however Executive orders are yet to stand the test of both the Judiciary and the legislature where the latter may view Executive Orders as a usurpation of their powers. It will be interesting to see how the above plays out in light of the current political ecosystem where the current government is utilizing innovative legal processed to ensure it delivers on its promise during this buzzer beater session in the political space.