Game-Changer Alert: IFRS 18 Revolutionises Financial Performance Reporting

The International Accounting Standards Board (IASB) has been on a course to improve the standards of reporting in the corporate world. Having come out to shape sustainability reporting in the recent past, the board earlier this month ramped up its efforts to enhance the relevance and clarity of information presented in financial statements. The introduction of IFRS 18 Presentation and Disclosure in Financial Statements exemplifies this.

This new standard allows investors to anticipate heightened transparency and comparability regarding companies’ financial performance and empowers them to make more informed investment decisions. Applicable entities who adhere to the IFRS Accounting Standards are now presented with a new model of financial performance reporting. While this standard was released on April 9, 2024, it will start applying to annual reporting periods beginning on or after 1st January 2027. Consequently, regulatory agencies will potentially initiate steps to ingrain these standards in their requirements, going forward, making it essential for corporates to take note of this new development.

IFRS 18 introduces three distinct sets of requirements to elevate the quality of financial reporting and furnishing investors with a robust framework for analysing and contrasting companies’ performances, as below:

- Enhanced comparability within the statement of profit or loss (income statement)

Presently, the format of income statements from companies is not standardised, allowing organisations to choose their own subtotals for reporting. This often results in variations in the calculation of operating profit among companies, diminishing comparability. An IASB study of 100 companies showed that over 60 reported a figure for operating profit using at least nine different ways to calculate it.

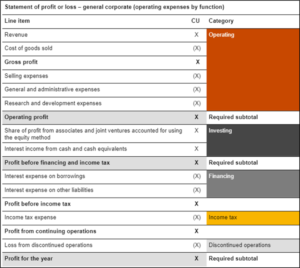

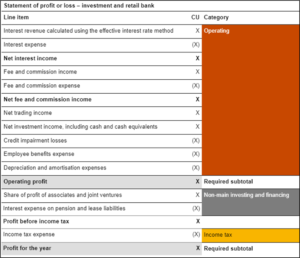

To remedy this, IFRS 18 introduces a structured approach to income and expenses into three defined categories—operating, investing, and financing. It then places an obligation on all companies to include new defined subtotals, such as operating profit. This standardised structure, and the addition of new subtotals, will offer investors a uniform foundation for assessing companies’ performance, facilitating easier comparisons.

- Improved transparency regarding management-defined performance metrics

Many organisations utilise company-specific metrics, commonly known as alternative performance measures, which investors find valuable. However, currently, companies are often lacking sufficient disclosure regarding the calculation and relationship of these metrics to required income statement measures.

Consequently, IFRS 18 will now require companies to have in place explanations for those company-specific metrics associated with the income statement, termed as management-defined performance measures. The goal here is to enhance the clarity and transparency of such metrics, allowing for audit scrutiny.

- Enhanced organisation of information in financial statements

Investors face challenges in analysing companies’ performance when provided with overly summarised or excessively detailed information. IFRS 18 now comes in to offer improved guidance on organising information and deciding whether to present it in the primary financial statements or in the notes. Primary financial statements consist of the statement of profit or loss (income statement); statement presenting comprehensive income; statement of financial position (balance sheet); statement of changes in equity, and statement of cash flows.

Potentially, these changes will offer more comprehensive and useful information to investors. Additionally, IFRS 18 mandates companies to provide greater transparency concerning operating expenses, aiding investors in locating and comprehending pertinent information.

Illustrative Examples:

- Sample Profit and Loss Statement for a General Corporate

Source: PWC

- Sample Profit and Loss Statement for a Bank (offering both investment and retail services)

Source: PWC

It is clear that IFRS S18 comes with alterations in the structure of the income statement and the introduction of additional disclosure obligations, which are likely to compel an entity to implement substantial modifications to its systems, charts of accounts, mappings, etc. The extent of operational adjustments demanded by the new standard should not be overlooked, and entities ought to commence contemplating the operational hurdles at the earliest opportunity.