Dynamics of the booming ‘mitumba’ industry and possible lessons for corporates

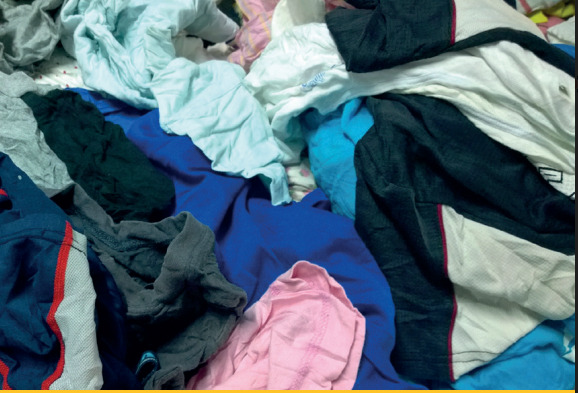

Second-hand clothes or ‘mitumba’ as they are popularly known in Kenya, are disposed of clothes previously worn in developed countries and imported to countries such as Kenya and other countries in Africa where they look fashionable and appealing, hence ‘trashion’. Many are familiar with the word fashion but trashion may not trigger any outright meaning. Trashion refers to used and thrownout elements that have been upcycled into useful items or even reused like in the case of second-hand clothes.

To put this into context, post the economic depression in the US, the then Head of State, Franklin Roosevelt, told Americans that the way out of that abyss was fearing fear itself. Part of the solutions he offered were local solutions to local problems and insisted that help would not come from anywhere but within their borders.

In the same vein, painting Kenya’s current economic state gives a dim picture. As such, it undoubtedly demands that both leaders and the citizens approach the dire situation without the fear of fear. Of concern is Kenya’s textile industry. For far too long, the industry has been on the ropes, creating room for the now booming ‘mitumba’.

Climaxing levels of demand

Kenya ranks among the highest importers of second-hand clothes within sub-Sahara Africa. This is largely due to the high levels of demand for affordable clothing and footwear in the country. Data from the Kenya National Bureau of Statistics (KNBS) posits that in 2019, preCOVID-19, Kenya received 185,000 tonnes of imported second-hand clothing, equivalent to about 8,000 shipping containers.

Further, statistics by the KNBS via the Economic Survey 2020 show imports of second-hand clothes constitute about 1% of the monetary value of all imports while it accounts for 2.5% of all private spending. The Survey further revealed that there was a stark increase in volumes of second-hand clothing imports into the country between the years 2015 and 2019, from 111,000 tonnes to 185,000 tonnes. Alongside the increase in volume, the unit price per tonne also ranged at soaring rates of between KSh 91,700 to KSh 96,300 per tonne over that period.

Reasons for the high demand

The insatiable consumer demand for mitumba revolves around the question of affordability, quality and fashionable trends. In comparison to new clothes, the view is that new clothes are a bit expensive and do not offer similar quality as second-hand clothes. Numbers actually speak to this. Earners who pocket average or modest salaries spend about 40% of their earnings on food, while the remainder is spent on other needs, including clothes and footwear. Average income earners in Kenya spend about 40% of their monthly earnings on food, while the remainder is spent on other needs, among them clothing. Data taken in 2019 before the pandemic, a period which seriously hit the mitumba business, shows that 2.5% of private consumption by Kenyans was on clothing and footwear; with an average expenditure of KSh 4,150 per year, totaling to KSh 197.5 billion.

Inter-sectoral links

The mitumba industry remains closely linked with other key economic sectors. Some of these sectors include finance, transport, insurance and research among others. In essence, it is an entire value chain. To further contextualize this, someone importing second hand clothes from whichever country, be it China, US, Japan or UK, has to use financial services offered by banks to make payments; rely on Cost Insurance Freight (CIF) schemes to follow up on their goods while in transit; and on arrival at the designated ports, the cargo is dispatched to various parts of the country, upon clearance, to various parts of the country. Even further, the flow continues to trickle down to sub-retailers or hawkers, and eventually to purchasers.

From a certain angle, this entire chain serves to unlock the sectors through the chain. The chain, right from researching on consumer preferences, procurement, transportation and storage, through to the consumer, is a plus to the economic fortunes of a country. Kenya’s Gikomba market is one such example. Through it, a huge chunk of the Kenyan population has directly and indirectly benefitted from the market as a result of the employment opportunities available therein, alongside the other benefits due to the sectoral linkages.

Proactive thought and action by corporates

Despite its booming nature, and possibly massive contributions to the economy, the far-reaching effects the mitumba business has on the environment cannot be down-played. That aside, the country’s local textile industry was once a key part of the economic driver, and fell largely due to market liberalisation. The potential in Kenya’s textile industy is massive and the existing gaps there can easily be taken up by corporates.

Kenyan corporates have continually sung the swan song of taking care of the environment through their sustainability policies or initiatives, but have forgotten key components. There has been a stealth import of plastic cloth waste into the country, and as such concentrating on one aspect of taking care of the environment while forgetting the other, is actually a zero-sum game.

Corporates, again have opened themselves up to investing through financing other components of the country’s industrial terrain such as sugar processing, which for far too long have not yielded fruits. It is time for a paradigm shift, so that players, including corporates actually walk the talk in terms of environmental conservation. The current approach towards environmental conservation is reactive rather than proactive, and that needs to change now more than ever.

Additionally, the local textile industry, with proper investment, opens up other interlinked sectors as well. It does look like corporates have steered away from investing in other economic sectors away from their main businesses. It cannot be denied that some of the leading corporates have massive acceptance in the eyes of the Mwananchi, and riding on that they could become world beaters. Take the example of Safaricom investing in the electronic bus space, or even an electronic transit platform for locally manufactured textile products? The end result is not only profits for the entity but also building a key component of the economy while also supporting sustainability.

The space is there, the opportunities exist, and policies already allow. It is time Kenyan corporates think and act proactively! Mitumba is indeed thriving, albeit, a booming local textile industry is a cut above!