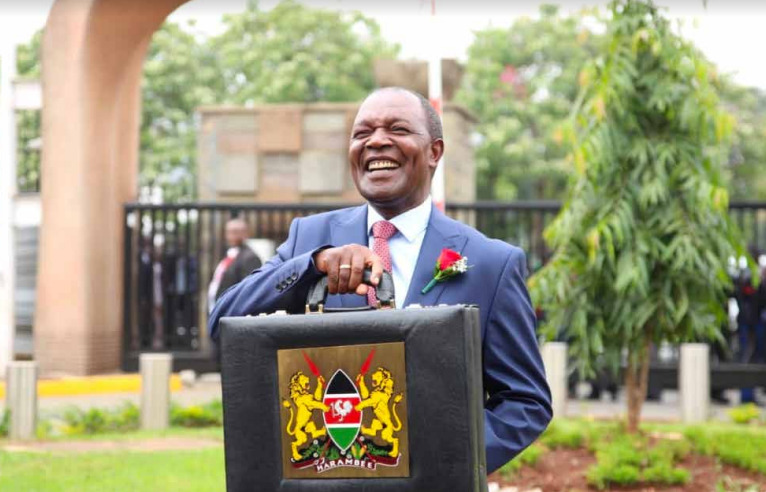

A break in the clouds of the 2023/2024 budget

Kenya Kwanza’s maiden budget has received some criticism since its presentation to the National Assembly, however, there are some commendable aspects in major sectors. The budget has been crowned as a path to growth, stabilisation and economic turn-around with the foreseen tough times that Kenyans will have to endure with the total budget coming to KES 3.68 trillion, a KES340 billion increase from yesteryear’s budget.

Education

The government has, one, employed over 30,000 teachers to improve the national teacher-pupil ratio; two, introduced a new funding model for higher education to make them inclusive and financially self-sufficient; and three, redesigned the Competency-Based Curriculum (CBC) to make it responsive to our educational needs.

To address the inequities in the education systems, KES 628.6 billion has been allocated in totality. This has been divided as follows:

- KES 12.5 billion has been set aside for Free Primary Education (FPE) and KES 65.4 billion for the Free Day Secondary Schools including insurance under the National Health Insurance Fund (NHIF);

- KES 25.5 billion will cater for Junior Secondary School (JSS) capitation, KES 5 billion will go towards examination fee waiver;

- KES 4.8 billion will be used for the recruitment of 20,000 intern teachers and KES 1 billion for the promotion of teachers;

- KES 1.3 billion will go towards training teachers on CBC and Sh400 million for the Digital l

Literacy Program and ICT integration in secondary schools;

- KES 4.9 billion for the school feeding program and KES 940 million provisions of sanitary towels;

- KES 30.3 billion on Higher Education Loans Board (HELB) and KES 97.5 billion for university education;

- KES 749 million on Research, Science, Technology and Innovation.

Agriculture

So far, the government’s achievements have been the subsidised cost of fertilisers and investment in biotechnology research as well as the uptake of drought tolerant crops to promote food security, granting duty waiver for the importation of key food products to bridge the food stocks deficit and lower and stabilise food prices.

In line with this, the budget proposal for the Fertiliser Subsidy Programme stands at KES 4.5 billion; KES 0.3 billion for the National Drought Emergency Fund; KES 87.9 for Agriculture and Food Security; and KES 1.3 billion for the Programme to Enhance Resilience for Food Production and Nutrition Security.

The rationale behind this is ensuring food security while reducing reliance on imports, wavering import levies and lowering the cost of food. The now assented Finance Bill, 2023 will see the lowering of the Import Declaration Levy and Railway Development Levy amid rising currency exchange rates and high cost of living globally.

This sector will also see the removal of annual inflation adjustments to the excise duty which will in turn create a predictable environment that protects the local producers, increase local value addition and effectively create employment.

Health

The government’s Bottom-Up Economic Transformation Agenda aims to increase investments in at least five sectors, one of them being healthcare. Having this in mind, the budget focuses on promoting access to quality and affordable healthcare through the Universal Health Coverage programme with a total allocation of KES 141.2 billion.

Notably, the key allocations are KES 18.4 billion for Universal Health Coverage; KES 5.9 billion for Managed Equipment Services; KES 4.1 billion for Free Maternity Health Care; KES 1.7 billion for Medical Cover for the Elderly and Severely Disabled in our Society; KES 21.6 billion for Kenyatta National Hospital; KES 12.8 billion for Moi Referral and Teaching Hospital; KES 8.8 billion for Kenya Medical Training College; KES 4.6 billion for Vaccines and Immunizations; KES 2.4 billion for Kenya National Hospital Burns and Paediatrics Centre; KES 2.5 billion for Construction and Strengthening of Cancer Centers; and KES 24.8 billion for Global Fund (HIV, Malaria, TB).

Manufacturing

With a goal to transform the Micro, Small and Medium Enterprise (MSME) economy, KES 300 million has been allocated to the Provision of Finances to SMEs in manufacturing, the revival of the Kenya Industrial Estates, establishment of a small and micro-enterprise development centre in every ward and industrial park and business incubation centre in every technical and vocational education and training institution.

Machinery and equipment used in the manufacture of pharmaceuticals will be exempted from Value Added Tax and this is extended to locally purchased products and an introduction of excise duty on imported sugar at the rate of KES 5.0 per kg excluding the sugar imported or purchased locally for use in the manufacture of pharmaceutical products.

To protect local manufacturers, the budget also proposes to introduce excise duty on imported cement at a rate of 10% of the value or KES. 1.50 per kg and 15% on imported paints, vanishes, and lacquers to protect local manufacturers.

There is also a proposal for the extension of the African Growth and Opportunity Act beyond 2025 to promote employee training and offer tax incentives for exporters.

Conclusion

The government aims at a net external financing of KES 131.50 billion and net domestic financing of KES 586.5 billion. On the other hand, a major question that looms is that of sustainability in spite of the budget deficit all in the hope of a 5.5% growth this year.