FINANCE BILL 2020: PARLIAMENT’S VIEW

TABLING OF COMMITTEE REPORT

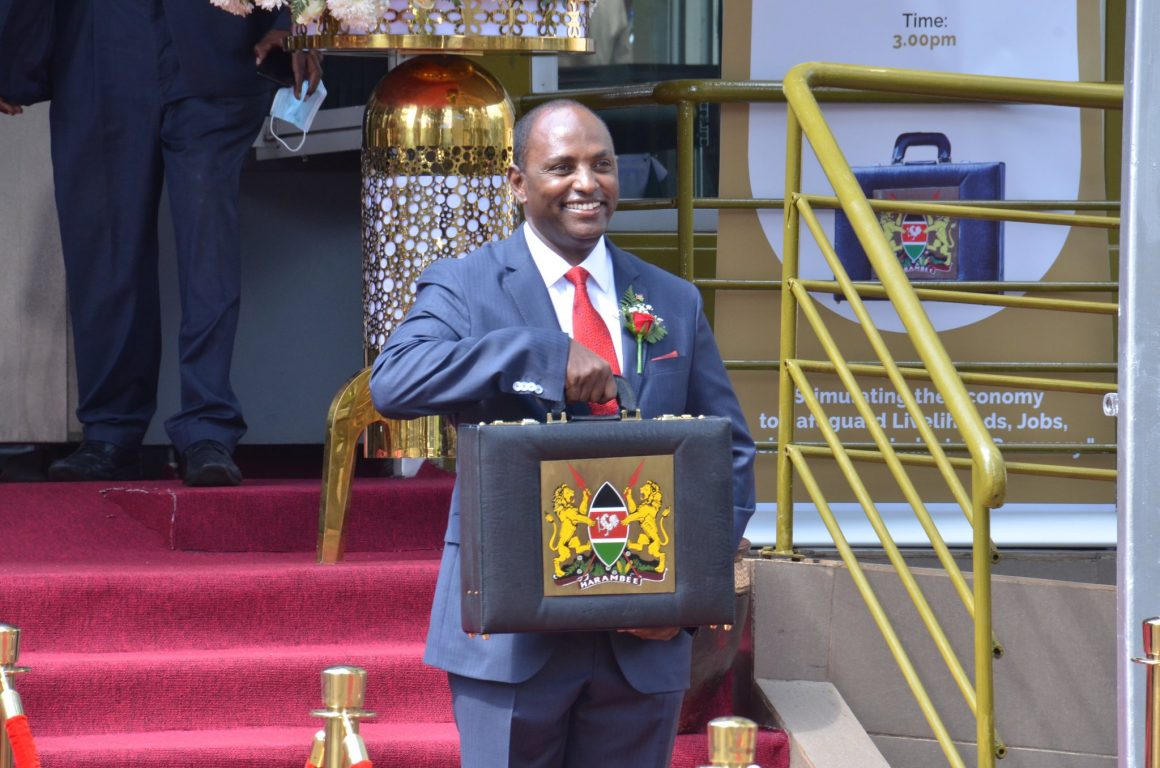

On 18th of June 2020, the National Assembly held its plenary session. Hon. Joseph Kirui Limo, the Chairperson of the Departmental Committee on Finance and Planning laid before the House the Committee’s report on its consideration of the Finance Bill 2020.

SECOND READING: KEY ISSUES

Scheduled in the order paper was the Second Reading of the Finance Bill, 2020 and Hon. Limo led the house in highlighting what the Bill has to offer for Kenyans.

a) Minimum tax proposal

On minimum tax for companies, the committee stated that there are 55 other countries that have such a tax and that it is a good tax. Kenya should incorporate it into our taxation framework.

b) Digital Service Tax

On digital service tax, the Committee explained that it was based on laws that were passed in previous financial years and that now it was time for Government to introduce the actual tax. The Bill seeks to enlist several agents such as banks so that they can capture the cash transactions.

Hon Limo mentioned Uber and how this digital tax will level the playing field as traditional taxi rides from drivers who pay taxes are more expensive than rides from drivers using foreign cab hailing technologies like Uber that do not pay tax.

The Committee challenged KRA to be innovative and collect taxes using technology.

There were mixed opinions on digital service tax. Roughly ‘40%’ of members of parliament who spoke felt like it was going to hinder the growth of youth industries.

There was a ‘20%’ that felt that the tax should be imposed but with checks to protect Kenyan youth such as having a set minimum that may be exempted.

The other ‘40%’ of members of Parliament supported the tax with some saying that it will teach the youth how to pay taxes. Other members stated that the tax is for non-resident companies as residents can always claim it back the when paying the other taxes.

c) Pension Tax

On the pension tax, the Committee submitted that after long consultation, there will be no taxation of pension. The Committee had managed to strike a compromise with National Treasury to avoid pension tax.

HOUSE SENTIMENTS

· A lot of the Countries pressing tax issues were dealt with in the Tax Amendment Bill, hence the Finance Bill is quite short.

· Some members were of the opinion that the proposed tax on LPG gas is meant to punish women.

Increasing cost of this fuel would result in a relapse to other less clean forms of fuel that have negative health impact on women who do most of the cooking in homes.

Some members stated that it will undo gains that have been achieved by the government that is keen on ensuring that people stop using charcoal as fuel.

· In this year’s budget speech something new was mentioned- Kazi Mtaani. We need a policy on the same that explains what it is and how it will be rolled out

· Payment of old persons, PWD and disadvantaged- We need to clarify the process and procedures for how data is collected and preserved, how payments are made, how people’s names appear or exit from the list. The Department Committee in charge needs to review or audit record data collection, review and maintenance as well as technology issues- System audit required to ascertain if there are any technology hitches.

· Recently parliament passed a supplementary budget reallocating 3 billion from the parliament budget to health and earmarked specific allocations for various county hospitals. To date, the Executive has not disbursed funds, this is unacceptable and requires follow up. Parliament needs an update on where the money is, and if it was disbursed by the National Treasury or is stuck at the Ministry of Health.

The Executive does not seem to take parliament decisions seriously. The allocated funds should be disbursed as they are needed to support corona interventions at county level, before the end of this financial year. House Committee dealing with Health and Committee dealing with Implementation to follow up.

- Provisions on landlord tax are welcomed as would increase revenue for Government

- CSR tax breaks to be retained. National Treasury has agreed to drop recommendations for removal of tax breaks linked to CSR activities.

- KRA to invest in smart tax technology to reduce time wasted arguing about taxes. Like Dubai, where every business person is linked to the tax authority system. Parliament will be moving amendments to provide for this.

All members of Parliament who wanted to speak were given a chance to speak and the House adjourned at 9:30 p.m. On Tuesday next week, the question will be put and the Bill will move to the Committee of the Whole where the House will discuss the recommendations in the report by the Committee of Finance and National Planning.

HIGHLIGHTS OF THE PROPOSED AMENDMENTS

The Committees proposed the following amendments to be considered by the House in the Committee stage:-

· Clause 2 of the Bill is being amended to raise the lower threshold of income subject to rental income tax from Ksh. 144,000 to Ksh. 288,000 to match the lower Pay As You Earn band in accordance with the amendments that were made in the Tax Laws (Amendment) Act, 2020.

· Clause 5 of the Bill is being amended by deleting paragraph (I) to retain the allowable deduction of expenditure incurred by a person or entity in the construction of a public school, hospital, road or any similar kind of social infrastructure. This is to encourage companies to invest in corporate social projects.

· Clause 8 of the Bill is being amended. The amendment is intended to retain the exemption for income of the National Social Security Fund. The deletion of the amendment is intended to protect the benefits of the members of the NSSF.

· The Bill is also being amended to retain the exemption from Income Tax the monthly pension granted retirees.

· The Bill is being amended by inserting a new clause immediately after clause 10 to save the VAT exemption under paragraph 102 that was available for existing projects under the special operating framework arrangement with the Government. Paragraph 102 was deleted in the Tax Laws (Amendment) Act, 2020.

· The Bill is being amended in clause 11 by inserting a sub-paragraph that removes the exemption of aluminium pilfer proof caps under tariff 8309.90.90 as the exemption for these products is no longer relevant.

· The Bill is being amended by deleting the exemption that was available for machinery and equipment in the construction of plastic recycling plants. This amendment seeks to restore the incentive that was intended to encourage investment in plastic recycling plants and was only inserted in 2019 which has not been in place long enough to allow for investment in plastic recycling.

· The Bill is being amended to make flour cheaper and affordable. The supply of maize flour under paragraph 108 was under exempt and has been moved to the second schedule on zero rated items.

· The Bill is being amended to zero rate the supply of flour. It is intended to make flour cheaper and affordable.

· The Bill is being amended to provide that the Commissioner should seek approval of the Cabinet Secretary before making inflation adjustment. Further, to require that the Gazette notice be laid before the National Assembly. The National Assembly should have power to check the power’s it has donated to the Commissioner to make inflation adjustments and, way or may not approve the adjustment.

· Clause 14 of the Bill is being amended to reset the threshold of alcoholic beverages subject to Excise Duty from “8%” to “6%”. The amendment will enhance revenue collection.

· There is a proposed amendment to remove excise duty on betting. This will reverse the negative effects of this tax on the industry, which led to closure of betting companies in Kenya while international players continue to operate.

· Clause 19 of the Bill is being amended to provide that the exemption from Import Declaration Fee is only available specifically to equipment, machinery and motor vehicles for the official use by the Kenya Defence Forces and the National Police.

· The proposed amendments also provide for the exemption from the Railway Development Levy to equipment, machinery and motor vehicles for the official use by the Kenya Defence Forces and the National Police.

· Clause 21 of the Bill is being amended to recognize the two categories of toll collectors provided for in the Act in the definition of the term “toll collector” i.e. public toll collector under section 4 and private toll collector under section 4B.

· Clause 22 of the Bill is being amendedto provide specifically that private toll collectors may only collect from roads constructed under Public Private arrangements, and to avoid instances of toll collection on roads constructed using public funds.

· Clause 25 of the Bill is being amended to ensure that the sources of funds for the Public Roads Toll Fund do not include monies from transit tolls. Further, the amendment seeks to provide for the purposes of the Fund.

· Clause 26 of the Bill is being amended to enhance the penalty for failure or fraudulently passing through a toll station without paying or failure to use the designated route for passage through a toll station.

· Clause 30 of the Bill is being amended to delete the proposed new definition of the term “consolidators” which sought expand the definition to include specific importers. The amendment is to retain the definition that was made in the Finance Act, 2019. This will ensure that consolidators are well regulated as they will be responsible for the consolidated cargo.

· Clause 31 of the Bill is being deleted. This will ensure that transit tolls levied under the Public Roads Toll Act are remitted to the Road Maintenance Levy Fund as currently provided for in the Act and not to the Public Roads Toll Fund proposed to be established.

· Clause 33 of the Bill be amended to ensure that the Kenya Revenue Authority is allocated a minimum of 2% of the revenue collected in the previous financial year.

· The amendment also provides that the Kenya Revenue Authority may receive a commission of not more than 2% of the revenue collected on behalf of a county government and that this should form part of the funds of the Authority.

· Clause 34 of the Bill is being amended to provide that the limitation of time for matters against the Kenya Revenue Authority is three years. This is to comply with different decisions of the Courts that have held that the Public Authority Limitation of Action Act cannot apply to the Kenya Revenue Authority.

· Clause 37 of the Bill is being amended by deleting the word “registered’ and substituting therefor the word “licensed’. The amendment seeks to ensure that the proposed protection of tax revenue held on behalf of the Kenya Revenue Authority by commercial banks and financial institutions during insolvency is effective by aligning the amendment to the language used in the Banking Act.

· Section 4 of the Banking Act provides for the “licensing” of persons and not “registration” as used in the proposed amendment to the Insolvency Act. The amendment is necessary in order to give effect to the purpose of the amendment of the Insolvency Act, 2015, as stated in the Memorandum of Objects and Reasons for the Bill.